9 Myths About Life Insurance

Oct 12, 2023 | 9 MIN READ

Over the years, you've probably heard stories about how many spiders the average person swallows in their sleep and have never thought twice about its validity. But is it true? Fortunately, no. There is no evidence supporting the statistic that the average person swallows seven spiders a year while sleeping. It’s nothing more than a popular myth designed to terrorize anyone with a fear of spiders.

Myths can distort our views on anything, and these distortions aren't limited to silly facts about eating spiders. The life insurance industry is also affected by life insurance myths, which can misinform and mislead those trying to make significant financial decisions. The only way to sort fact from fiction is by addressing and clarifying common life insurance myths.

Common Life Insurance Myths

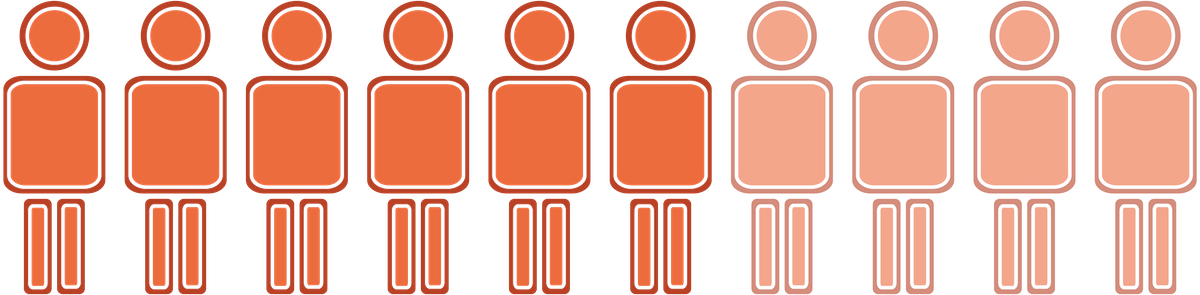

If you’ve fallen victim to any of the myths outlined in this article, you are not alone. According to the Life Insurance and Market Research Association (LIMRA), six out of ten people, fed by common misconceptions, didn’t buy life insurance because they didn't know what to buy or how much.

Myth #1: Life Insurance Isn't Affordable

This myth is the most obvious reason not to buy life insurance. It makes perfect sense. What's the point of buying something you can't afford? Still, is life insurance really that expensive? Maybe not. According to a study conducted by LIMRA in 2021, more than half of Americans overestimate the price of life insurance by about three times its actual cost. It's incredible to think about really. Imagine going to the store to buy a pantry staple and having it be roughly three times less than what you were expecting. That's a pretty nice surprise, right?

Sometimes we think about life insurance and figure there must be a hefty price tag associated with protection, but this isn't always the case, and the price will depend on you.The pricing of life insurance essentially comes down to one thing, you. What are your needs? Are you looking for permanent coverage spanning the duration of your life, or are you looking for something temporary that can help replace your income?

Other factors can also affect the overall cost of your coverage, including your age, health, family medical history, and gender. Based on those factors companies must determine how much of a risk you are and set their rates. For example, someone who is younger with a clean bill of health will always receive a better rate than someone older with a medical history because the younger person is far less likely to die first.

Myth #2: Term Insurance Over Whole Insurance, No Matter What

You often see people compare these types of insurance like they are comparing apples to apples, however this isn’t useful when it comes to life insurance products. The fact is they aren't the same and, therefore, should not be compared as if they are. It’s like comparing a luxury car to a sedan. They both share common characteristics, but beyond that, they’re quite different.

Both term and whole life policies were designed with a specific end-user in mind and are unique in their own way. The tricky part is determining which product is right for you. Let's go over a few of the pros and cons of both term and permanent, or whole, life insurance.

Term Life Insurance

The pros of term life insurance include:

- Simple to understand

- Arguably the most affordable form of life insurance

- Perfectly designed to cover you for a specific amount of time, and is great for purchasing additional coverage when needed

- Can often be converted into permanent insurance

The cons of term life insurance policies include:

- No cash value

- Protection disappears once the term ends, or if you stop paying

Whole Life Insurance

Some pros of whole insurance include:

- Lifelong coverage that doesn’t expire, as long as the premiums are paid

- Growth in the cash value provides a financial security blanket if you need to withdraw from or surrender the policy

- Non-forfeiture options give you the opportunity to continue the policy as term insurance or as a paid-up policy with a reduced death benefit

- Rates will ordinarily stay the same throughout your life

The con of whole life insurance is:

- This type of policy is far more expensive than term insurance

Determining which is best for you isn't as easy as looking at a pros and cons chart. The truth is, you should probably have a mix of both, as it gives you the most protection and flexibility.

For example, having a smaller whole life policy combined with an ample term policy is perfect if you want to protect your family from the potential financial crisis associated with the death of the primary wage earner. This strategy gives you the power to cover your family until your children are old enough to support themselves while leaving you with enough coverage to help with final expenses.

Myth #3: Don’t Buy Life Insurance, Invest Instead

Can you invest your money instead of buying life insurance and potentially make more? The brief answer is yes, but that's only a small piece of the overall picture.

One of the primary benefits of life insurance is the ability to pass along your money to the people who matter most to you. Moreover, unlike most investments, these funds are generally delivered, tax-free, to the named beneficiaries.

If you bought life insurance and tragically died in an accident the next month, your family would most likely receive a death benefit greater than the amount at which you started. Much like many financial decisions, the appropriate financial plan depends upon your needs. When it comes to life insurance and investing, one isn’t necessarily better than the other, they’re just different. There is room and a place for both. Consult with a financial advisor as you make decisions for your financial future.

Myth #4: Employers Provide Enough Coverage

Frequently, employer-provided life insurance policies provide one to two times your salary in coverage. The average salary in the United States is about $55,000 a year, according to Indeed. This means that millions of workers who receive life insurance coverage as a benefit are likely receiving less than $110,000 in coverage. In fact, many businesses might have a flat rate of coverage which is not tied to salary amounts, resulting in even less coverage.

As a result, many people are under-protected by insurance policies linked to job benefits. Professionals recommend a life insurance benefit that is about 10 or 15 times your salary. So, if businesses are only promising one or two times the salary amount in coverage, families might not have enough financial resources to stay afloat after a loved one has passed.

Myth #5: Employer-Provided Coverage Will Last

On the topic of life insurance options as a job benefit, many workers assume they can take their insurance policy with them after they leave their job. Unfortunately, businesses care about their workers as long as they are on the payroll. As soon as you leave that company, your coverage will end.

Additionally, many workers have families that they need to take care of. Employers might provide additional coverage options, but this can be more expensive than purchasing a life insurance policy from an alternative insurance provider. Moreover, it’s very common to stay at a job for only a few years. So, as you move around your policy options will change frequently. Selecting one insurance provider that will remain with you through all stages of your life can ensure consistent coverage at a cost that works well for you.

Myth #6: Only a Breadwinner Needs to be Covered

The first myth may have been the most obvious reason not to buy life insurance, but this one is the most unfortunate. This falsehood can be summed up with a classic phrase: you don't know how important something is until it's gone.

Thinking about our own death is hard enough, but thinking about losing a loved one is even harder. In a single income household, you often see one parent working while the other stays home to raise the children, which is a profession itself. So, what happens if that person dies? Who does their various jobs?

These are just some of the many hidden expenses of losing someone who isn't the "breadwinner”:

- Childcare

- Cooking

- Handling financials

- Cleaning/maintaining the home

- Running crucial errands

It may not seem like much at first, but all these things add up in the end. You might be able to handle most of these tasks yourself, but it will require a significant amount of time, time you may not have.

Myth #7: It’s Impossible to Qualify for Life Insurance

We have now addressed the most unfortunate and reasonable myths, so why not talk about the least true? Qualifying for life insurance is not impossible by any means. There are products made for everyone, including guaranteed issue policies, which you can purchase regardless of your health.

These policies tend to be more cost prohibitive than typical coverage and will only guarantee a death benefit after a certain point, such as two years. This constraint doesn't always suggest the money is gone though, just that the company will refund any premiums and not pay the death benefit in the event the owner dies before a specified time.

There are also a lot of other policies out there, many of which are easy to qualify for under normal circumstances. If you want to learn more, we recommend contacting an independent insurance agent.

Myth #8: Single People Without Children Don't Need Life Insurance

You begin to notice a trend after you've seen enough advertisements for life insurance. These ads often include phrases like “loved ones,” “income replacement,” or “peace of mind.” This sort of phrasing encompasses traditional life insurance policyholders, however, that doesn’t mean life insurance is only for them.

If you are single, with no children, ask yourself: Who pays for the funeral if anything happens to me? What about my parents, will they depend on me as they age? If something happens to me, who will care for them?

Unfortunately, you could face some of these questions in the future, so why not be prepared?

There are also less grim uses for life insurance that don't involve your funeral or replacing your income. You can purchase a policy for charitable reasons, like donating to a school or foundation. This method allows your donation to grow into a substantial contribution, ordinarily much larger than the amount you first put in.

Myth #9: I'm Young and Healthy, I Don't Need Life Insurance

This myth itself isn’t technically wrong. Younger individuals who don't have families and have parents who are still working, may not necessarily need life insurance. Although, this doesn't mean you shouldn't get protected when you’re young.

In all actuality, it’s the best time to buy, especially when it comes to permanent policies. By doing so, you lock in a rate that should be relatively less expensive compared to what it would be later in life should your health decline.

.png?width=3010&height=1453&name=Term%20vs%20Traditional%20Life%20Graph%20(30%20-%2060).png)

These illustrations assume that the 30-year old and 50-year old have the same level of health, which isn't the case typically. If the older between the two happens to be unhealthy, their rates could be much higher than the numbers shown above.

Still not sure if you should buy a policy yet? Ask yourself one simple question: "Do I ever plan on having a family?"

If your answer is yes, then why not lock in an affordable rate early on?

The Truth About Life Insurance

There are many myths about life insurance out there, and all we can do is sift through the information to find the truth. What we do know is that life insurance is designed to support your family should something ever happen to you.

If you are interested in learning more about life insurance, we recommend speaking to an independent insurance agent from ELCO Mutual, as they should be able to answer any questions you may have. Ready to get started? Don’t hesitate to reach out right away and learn more about life insurance options that are right for you.

ELCO Mutual and its representatives are not legal or tax advisors. For legal and/or tax advice, please see your tax/legal adviser.

All illustrations within this post are based on products from ELCO Mutual Life and Annuity and are meant to be generalized. These illustrations are not offers and have no contractual binding. These products are not available in all states. For more information regarding ELCO and its products, please contact the home office.