Tax Advantages of Life Insurance & Annuities

Jan 04, 2024 | 6 MIN READ

When considering how to prepare for your financial future, saving money on taxes is one strategy you want to leverage. That money saved can be used elsewhere, improving your overall financial standing.

Life insurance and annuities are two types of tax-advantaged financial vehicles that can help provide security for you and your loved ones. You might think of the two as opposites: life insurance provides a lump sum in return for a stream of premium payments, while annuities guarantee a stream of income in return for a lump-sum payment. Because both can provide tax advantages, understanding the benefits associated with these products can help you determine which one is right for you.

Quick Links:

- Life Insurance vs. Annuities

- How Do Taxes Differ for Life Insurance vs. Annuities?

- Turn to ELCO For Life Insurance and Annuities

Life Insurance vs. Annuities

Before we can discuss the tax advantages of life insurance and annuities, we need to establish the difference between each product. Both of these aim to provide financial stability, but the way they achieve this is very different from one another.

Let’s start with life insurance. There are several kinds of life insurance options, and all of them provide financial support for beneficiaries after a policyholder has passed away. To ensure this financial security, policyholders are required to pay monthly premiums. Depending on the type of insurance policy, these premiums, which are determined by the health and medical history of the policyholder, can provide living and death benefits. For example, living benefits may be dividends that can help reduce the cost of premiums, while death benefits might include an inheritance for a family member or some money to cover the cost of end-of-life expenses.

Alternatively, an annuity is an insurance contract that provides payouts in the future. When considering this option, you can either purchase an annuity with a lump sum payment, or steadily make contributions over time. You also have the option between fixed annuities and variable annuities. Fixed annuities will pay a guaranteed interest rate, while variable annuities invest your money into mutual funds where the growth may vary (hence the name). By the time you retire, you will be able to access the money that accumulated from your annuity and use it as a form of income.

How Do Taxes Differ for Life Insurance vs. Annuities?

Life insurance and annuities are two very different products, even though they have overlapping functions. Due to their differences, you can’t expect each product to have the same tax benefits. Life insurance policies and annuities have their own sets of tax advantages, meaning one product might be more beneficial to you than another.

Life Insurance

Here are a few of the tax advantages of life insurance policies.

Life insurance allows for tax-free transfer of wealth

A life insurance benefit is generally delivered to heirs free of tax. The main exception is in estates subject to inheritance or estate tax. Even in these cases, however, there are ways to keep a life insurance policy out of the taxable estate.

The other situation in which a portion of life insurance proceeds would be taxed is if they are held in an account for a period of time after the insured’s death. If the death benefit accumulates interest before it’s distributed to a beneficiary, then the interest received is subject to tax. Because a life insurance policy’s death benefit is generally tax free, many people use life insurance to pass more money down to their loved ones.

You can take a tax-free loan from a whole life insurance policy

When you buy a whole life insurance policy, it accumulates cash value over time. Like the money in an annuity, this cash value typically grows tax deferred. You can access the cash value portion of a whole life policy by taking a loan against it. You don’t necessarily have to pay the loan back, either. However, any unpaid amount will be deducted from the death benefit. It’s also important to keep in mind that if you eventually surrender the policy or it lapses due to a lack of premium payments, the entire loan plus interest will become taxable.

Annuities

Alternatively, annuities have their own sets of tax benefits. Take a closer look at the benefits of annuities here.

Tax deferral helps annuities grow faster

Certificates of deposit (CDs) are popular because they’re safe savings vehicles that offer a guaranteed rate of return. In times of low-interest rates, however, those rates of return may not outpace inflation. As of December 2023, CDs are boasting an average rate of 1.73% for a one year term, well below typical rates of inflation. Annuities are often able to offer more generous interest rates.

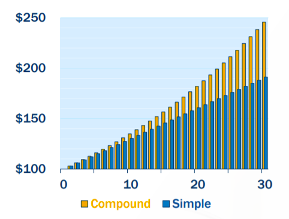

Additionally, the earnings that money in a CD does generate are subject to annual taxes, further limiting the account’s growth potential. Unlike CDs, annuities are taxed only on withdrawals. Tax deferral is particularly beneficial for accounts that accumulate compound interest. When taxes aren’t taken out of an account each year, more money is left to earn interest over time, and the account is able to grow at a faster rate.

Annuities don’t have contribution limits

When making a plan to save money for retirement, you’ll find that different savings accounts have contribution limits established by the IRS. For 401(k)s and Individual Retirement Accounts (IRAs), you’ll be capped at a given contribution limit each year. This isn’t the case with annuities. When putting in money, you can allocate as much as you would like. The more you put in initially, the more it will compound tax-deferred, and the more guaranteed income you’ll receive later on.

Turn to ELCO For Life Insurance and Annuities

Life insurance and annuities weren’t created to be one-size-fits-all products. Each serves their own purposes and caters to different sets of needs. That’s why it’s important to thoroughly evaluate each one as well as the tax advantages of them. To help you determine which life insurance or annuity products are best for you, it’s best to speak with an experienced independent insurance agent that can help you navigate the differences between them.

ELCO Mutual offers a variety of whole life insurance policies and annuities to meet a range of financial needs. To learn more about these types of products, see our commonly asked questions, browse our blog, or reach out to one of our independent insurance agents.